In my previous articles on how to earn high yield from Anchor’s saving protocol (see part I and part II), I mentioned one of the the potential risks could be a decreasing net APR i.e. the cost of borrowing UST becomes higher than the return from depositing UST to Anchor. This has happened already and the net APR at the time of writing is 0.33%, dropping from the 17% when I wrote the previous articles at the end of September 2021.

For those who follow Anchor closely, this is not news. The net APR on Anchor has been extremely low since early October after Terra’s Columbus-5 upgrade (more details here). This is mainly due to the cliff-dropping utilisation rate (deposit over borrow ratio) on Anchor — too much UST borrowing demand and not enough UST deposits. It is not a coincidence the UST demand started to shoot up at around the same time Nexus and Valkyrie protocol were launched on October 5th and 8th respectively (Pylon launched on June 21st 2021). So for those who still hold the borrowed UST in Anchor earning only 0.33% (possibly even negative) net APR, what can you do to make a better return? Luckily there are newly launched protocols on Terra that can give you a three-digit % return!

I’ll explain how to switch from Anchor to the two newly launched protocols on Terra — Nexus and Valkyrie, as well as Pylon to increase your return on the borrowed UST. Before going into the details, here are the protocol tokens that you need to get familiar with:

- UST: TerraUSD is the decentralized and algorithmic stablecoin of the Terra blockchain. It is a scalable, yield-bearing coin that is value-pegged to the US Dollar (source: CoinMarketCap).

- bAssets: Bonded assets (i.e. bLUNA, bETH) are tokens that represent a staked asset (i.e. LUNA, ETH). bAssets give out block reward to the holder and are fungible and transferable like the staked assets.

- VKR: The governance token of the Valkyrie protocol. The price of VKR at the time of writing is 0.5 UST, down from 2.5 UST on the launch day.

- MINE: The Minerals Token (MINE) is Pylon Protocol’s native governance token. The price of MINE at the time of writing is 0.07 UST, down from 0.2 UST when it was launched.

- Psi: The governance token of the Nexus protocol. The pre-sale price was at 0.01 UST per $Psi and priced around 0.101 UST at the time of writing.

How does it work?

You first need to have UST in your Terra wallet to participate in these protocols. If you still hold the borrowed UST from Anchor, you can withdraw the UST from Earn on Anchor then use it to invest in the other protocols. There are two alternative protocols Valkyrie and Pylon that can give you a higher return than the 19% APY on Anchor from depositing UST; and one protocol Nexus that can generate returns from the bonded assets :

- Valkyrie staking (198% APR) and VKR-UST LP (346% APR)

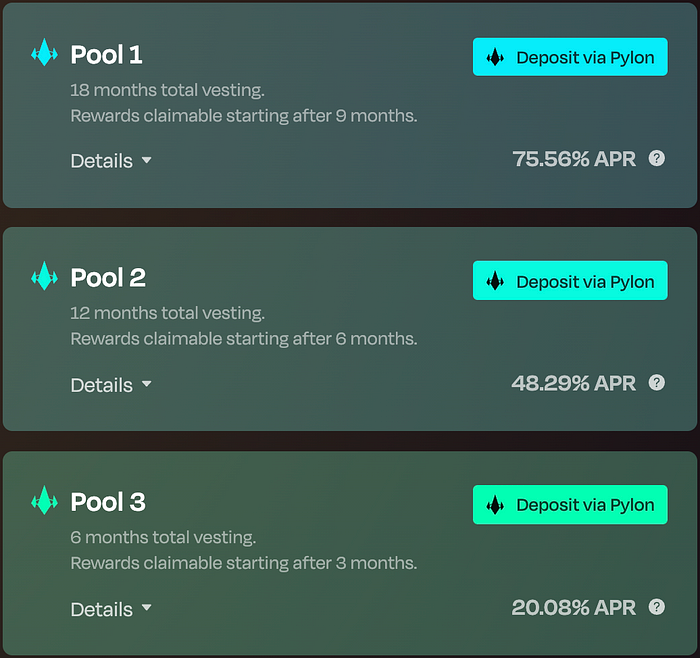

- Pylon UST deposit pools (VKR reward APR ranging from 20%–75%; MINE reward APR ranging from 16%-45%)

- Nexus vault for bAssets — bLuna (8.36% APR) and bETH (8.6% APR)

Valkyrie Protocol

Valkyrie is a protocol built to support a rewardable ecosystem through on-chain campaigns where creators launch campaigns on Valkyrie to promote their projects and participants who share content to new users get rewarded by receiving Valkyrie’s VKR. Here is an example of a campaign currently listed on Valkyrie. Pylon offers rewards in its own governance token MINE and in VKR for those who participate in the protocol or sharing it. You can surely participate in the campaign of Pylon and earn yield, but in this section I’ll focus on how to earn from Valkyrie’s own protocol. In the Pylon Protocol section next I’ll explain in more detail how to earn from Pylon.

Assume you already have UST in your wallet, here are the steps you can take to earn from Valkyrie:

- Go to Valkyrie’s Trade, swap some VKR with UST. Make sure you leave a small amount of UST for the transaction and trading fees.

2. Go to Stake, you can stake the governance token VKR to earn 198% APR; or provide liquidity in VKR-UST pool to earn a higher APR of 346% due to the higher risks incurred from impermanent loss.

Pylon Protocol

Pylon is a protocol for programmable payments that helps alignment between payers and payees (more details here). The protocol currently has multiple campaigns that reward participants with VKR and MINE.

With the UST in your wallet, you can earn MINE from either of the following three pools and receive higher yields the longer you commit your UST deposit. Although the shortest deposit 6 months only gives you 16% APR, which is lower than the 19% from Anchor’s UST deposit, the other two longer deposit options offer much higher return.

Or you can earn VKR from the following three pools and receive even higher yields than earning from MINE.

Nexus Protocol

Apart from investing UST to the two protocols to earn yield, you can also earn from your bonded assets (bETH and bLuna) on Nexus. Nexus is designed to provide a safe vault that automatically manages Anchor Borrow for users. It maximises users yield while eliminating the risk of liquidation when the LTV exceeds the maximum allowed threshold. This automated system managing ANC reward claiming and interest balancing gives around 1.5% higher yield than the manually managed one.

If you already have UST and don’t need to borrow any from Anchor, you can withdraw the collaterals (bETH or bLUNA) from Anchor and deposit them to Nexus vault to earn 8% APR and at the same time earn Psi reward token.

Summary

With the two protocols mentioned above, you should be able to earn a return higher than the cost of borrowing UST on Anchor; or you can simply earn yield by depositing your bonded assets to an automated staking system like Nexus.

The Terra ecosystem is growing quickly and there are many more protocols in the pipeline to be launched in the near future. Keep an eye on these future projects here because they might be offering unexpected rewards and returns.